Friday 15th March 2024

This Week On Crypto Predict

This week, Crypto Predict is thrilled to debut 'Grilling the Marshmallows with...'—our recurring interview section featuring insights from crypto entrepreneurs and investors. Additionally, dive into our customary BTC forecast and explore an overview of the week's crucial topics, alongside a spotlight on cross-exchange trading. Wishing you a fantastic weekend, and we'll catch you next week!

Grilling the Marshmallows with…Nicolas Weber, co-founder at The Hub

Hey Nicolas, how are you? Tell us a bit more about yourself

I am Nicolas Weber, an early stage web3, Metaverse and AI investor, writer, and entrepreneur. Additionally, I am the Founder and CEO of The DAC and Founder of THE HUB. I previously Co-Founded Amazing Blocks. Furthermore, I am the Co-Founder of the Tokenization Working Group at the European Blockchain Association and advisor to FITCHIN, Bundles, KROWDZ, Blockchain Founders Group, VIIO, Espacio Creador. I previously worked for established companies such as Daimler, Dieffenbacher and Allianz Global Investors.

When did you join the Crypto community?

I joined crypto in 2016 and have been most interested in the topics around decentralization and the convergence of web3, AI and creativity. Therefore my favorite coins and tokens also revolve around these topics such as ETH (creativity's infrastructure layer), FETCH (infrastructure for AI agents), Metaverse and gaming tokens like SAND, MANA, APE, AXIE and others, Metaverse and web3 commerce platforms like BOSON and a few more in these sectors.

Tell us more about The Hub

THE HUB is the go-to platform for creators in the Spatial Web, accelerating decentralized creativity through tool aggregation and community convergence. Its product suite includes:

THE HUB Citizens (Access): Creator membership granting access to tools, assets, and over 200+ worlds and experiences.

The Portal (Create and Own): A groundbreaking file format and blockchain-interoperable 3D content generator.

The Explorer (Analyze and Monetize): AI-powered pricing of 3D content, asset analytics platform, and aggregation of distribution channels.

Together, these tools form a comprehensive solution for creators. The journey began with bootstrapping a community of over 10,000 active members and raising a $500,000 Pre-Seed Round from notable investors. So far, THE HUB has generated over $750,000 in revenue from 30+ clients, with +400,000 monthly API calls on the analytics tool. Over 7,000 developers have been onboarded to the editor.

What’s in the pipe for you in 2024?

For 2024 we have a large expansion campaign planned to take THE HUB to the next level. This includes on the one hand the launch of THE HUB CITIZENS which we are currently executing that will lead to a creator league to gamify and financialize the creator industry and the $HUB token launch we are preparing as the creator cultures currency. Furthermore there are various updates on the tools planned such as the integration of Chainlink's CCIP to enable smooth blockchain interoperability and the expansion of our AI appraisal models toward broader 3D content use cases.

Any predictions for 2024?

My prediction for the crypto industry in 2024 - which is of course like everything no financial advice - is that we will gradually move the focus from infrastructure to applications again. The last 2 years have been very infrastructure dominated when it comes to capital deployment and narrative. With the abundance of L1s and L2s we now have, we need to focus again on applications that are incentivized by and built on top of these infrastructure layers. Otherwise we will never reach true adoption outside of financial applications.

What is your advice for new crypto investors?

My general opinion is that people who have a long term vision and like to build wealth sustainably should rather follow a learning by doing and gradual DCA approach, instead of following hypes and FOMO. Do not get on hypes that are peaking but rather try to anticipate the market and above all, also take profits and save them outside of the volatile crypto markets. One key mistake people make in bull markets is that they invest, exit with good profits and directly reinvest the capital plus the gains into other crypto projects. At times and early stages of bull markets this may work but the longer the bull lasts the riskier it gets.

You can reach Nicolas at: nicolas.weber@thedac.info

More info on The Hub: https://www.thehubdao.xyz

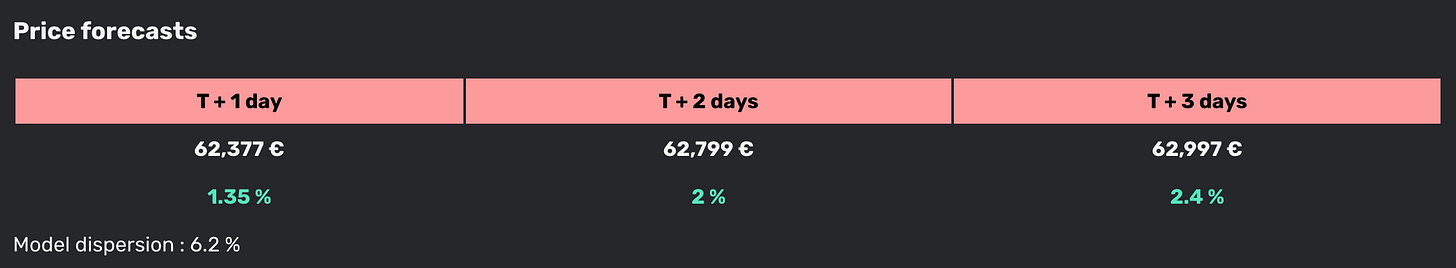

BTC price Forecast

Backtesting Forecast Accuracy: 56.04%

Red: Actual

Blue: Forecast

All graphs provided by CryptOptions

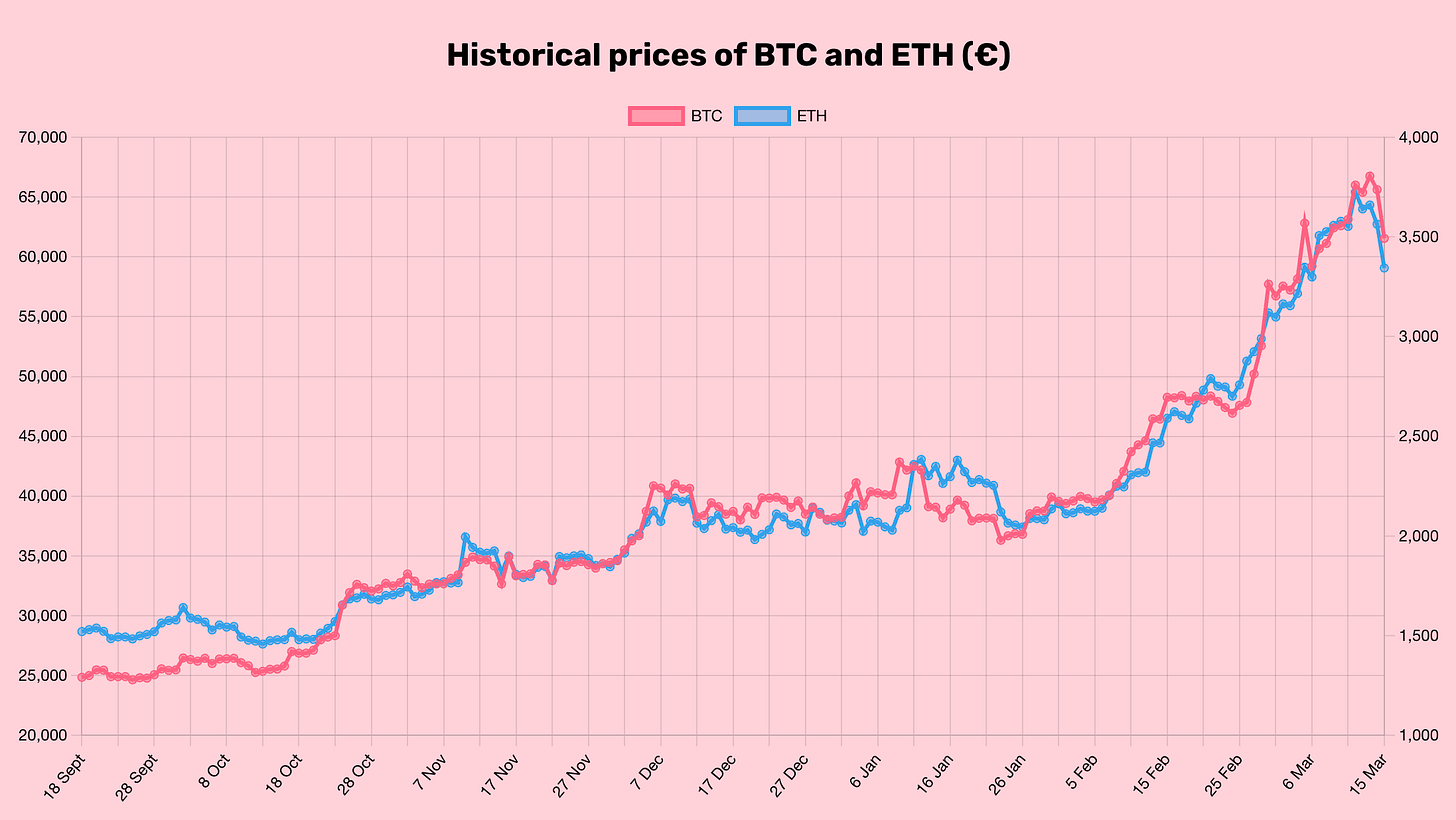

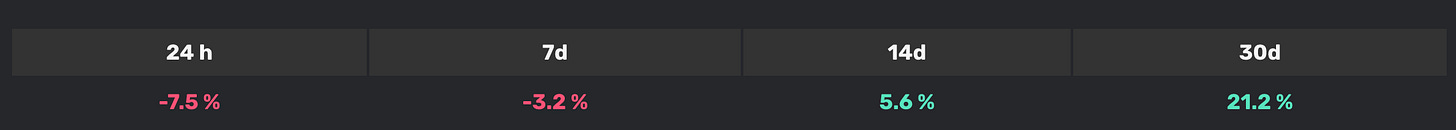

BTC price (EUR) and volatility

Historical Volatility (last 30-day daily returns) : 61.71%

All graphs provided by CryptOptions

BTC & ETH (EUR) Price Correlation

All graphs provided by CryptOptions

Correlation between BTC & ETH and BTC & USDT

All graphs provided by CryptOptions

BTC Correlations with Majors Cryptocurrencies

30-day correlation

All graphs provided by CryptOptions

Index Variations

Major Cryptocurrencies Index (BTC, ETH, SOL):

All graphs provided by CryptOptions

What to Know Regarding…Arbitrage in Crypto

TL;DR: Crypto arbitrage is a strategy to profit from price differences across exchanges. Techniques like cross-exchange, triangular, convergence, statistical, and spatial arbitrage offer ways to capitalize on these variations. Traders must act swiftly and consider transaction fees and market risks. Popular cryptocurrencies like Bitcoin, Ethereum, and Solana are often prime targets for arbitrage due to their widespread adoption and availability on multiple exchanges.

Embarking on your crypto trading journey? You've likely come across the term "arbitrage" – a widely used strategy in the crypto world offering potential gains with reduced risk. In this guide, we'll delve into five proven crypto arbitrage techniques to navigate the volatile markets with confidence.

First of all, you need to understand arbitrage involves taking advantage of price differentials for the same asset in different markets. In cryptocurrency, this means buying a cryptocurrency on one exchange where it's priced lower and selling it on another exchange where it's priced higher, thereby profiting from the price difference. However, they must account for transaction fees incurred during buying and selling, which can affect overall profitability.

Cross-Exchange Arbitrage: Utilizing two separate exchanges for buying and selling, this strategy exploits price differentials between platforms. By purchasing a cryptocurrency at a lower price on one exchange and selling it for a higher price on another, traders can pocket the difference. Timeliness is crucial to mitigate risks associated with rapid market changes.

Simple Triangular Arbitrage: This technique involves exploiting price differences among three cryptocurrencies. For instance, starting with Bitcoin (BTC), purchasing Ethereum (ETH), then Ripple (XRP), and ultimately selling XRP back for BTC. Quick action and market awareness are key to seizing opportunities, though risks like transaction delays and fees must be considered.

Convergence Arbitrage: More complex than triangular arbitrage, this method capitalizes on price convergence across different exchanges. By buying low on one exchange and selling high on another, traders aim to profit from price equalization. However, volatile markets and unforeseen price fluctuations necessitate careful risk management.

Statistical Arbitrage: This advanced technique relies on complex algorithms to identify trading opportunities based on statistical trends. By making numerous trades and banking on aggregate profits, traders aim to capitalize on market inefficiencies. However, a deep understanding of market dynamics and risk management is essential for success.

Spatial Arbitrage: Taking advantage of price variations between different regions, spatial arbitrage involves buying low in one location and selling high in another. This strategy requires awareness of transaction fees, regulatory differences, and potential delays in transferring cryptocurrencies between exchanges.

Each arbitrage technique offers its own opportunities and challenges, requiring traders to stay informed and adaptable in the dynamic crypto landscape. bear in mind too that cryptocurrencies ideal for arbitrage trading typically encompass widely recognized options such as Bitcoin, Ethereum, or Solana. These coins boast high levels of adoption, substantial trading volumes, and availability across numerous exchanges. These factors contribute to the emergence of price divergences among platforms, providing traders with lucrative opportunities to exploit for arbitrage purposes.

Alt-Coins of the Week

Ox Protocol (ZRX) 7d%: +155.27%

0x is an infrastructure protocol that allows users to easily trade ERC20 tokens and other assets on the many different blockchains (including Ethereum) without relying on centralized intermediaries. It is a protocol for decentralized exchange.The protocol is used by companies building web3 apps such as wallets, DEXes, portfolio trackes, and others. It is a used by hundreds of developers for their projects. The protocol has facilitates over $200B in trading volume since its inception.

NEAR Protocol (NEAR) 7d%: +41.40%

NEAR Protocol is a layer-one blockchain that was designed as a community-run cloud computing platform and that eliminates some of the limitations that have been bogging competing blockchains, such as low transaction speeds, low throughput and poor interoperability. This provides the ideal environment for DApps and creates a developer and user-friendly platform.

Maker (MKR) 7%: +30.98%

Maker (MKR) is the governance token of the MakerDAO and Maker Protocol — respectively a decentralized organization and a software platform, both based on the Ethereum blockchain — that allows users to issue and manage the DAI stablecoin. Initially conceived in 2015 and fully launched in December 2017, Maker is a project whose task is to operate DAI, a community-managed decentralized cryptocurrency with a stable value soft-pegged to the US dollar.

Blips on the Radar

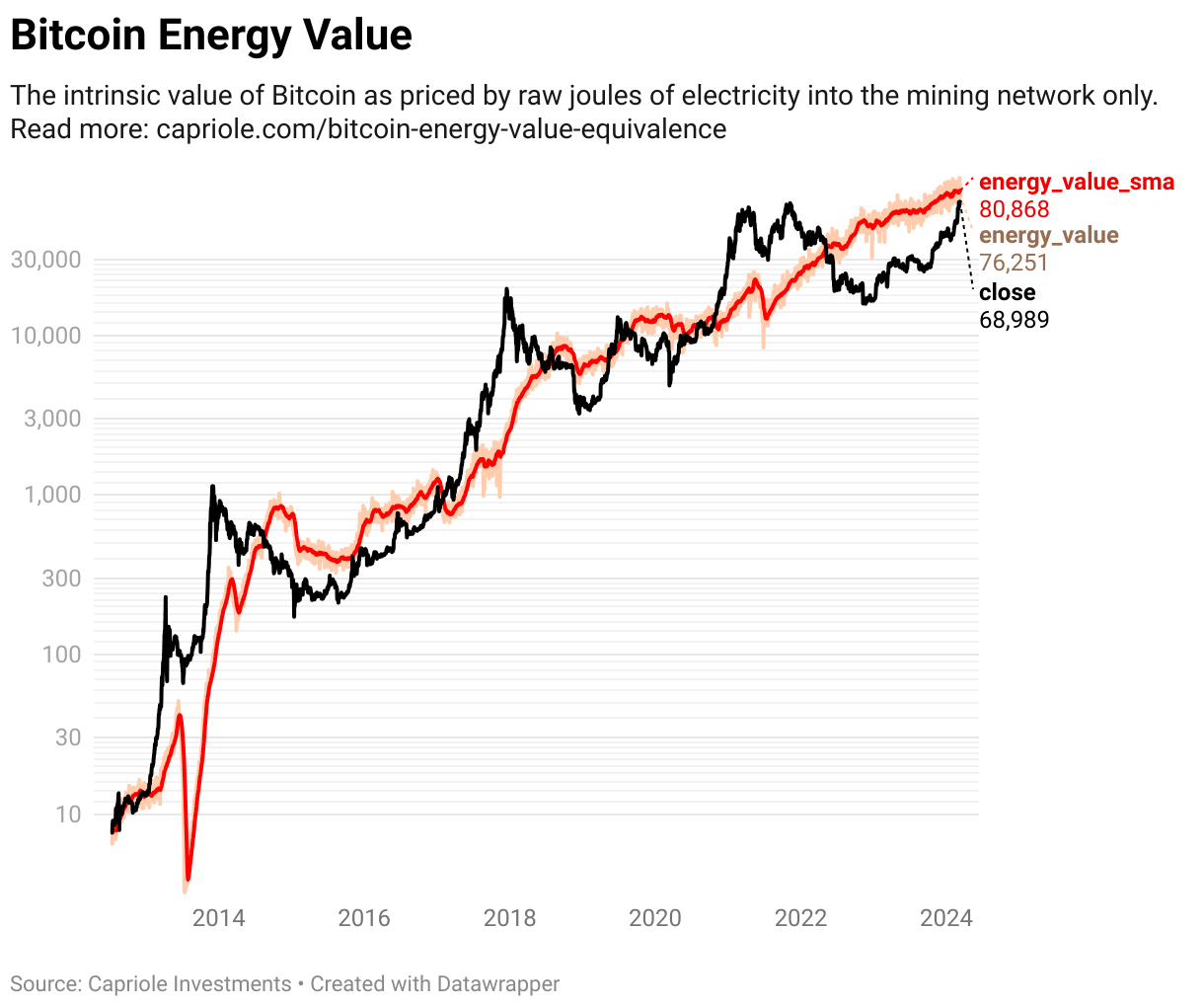

BTC

Capriole Investment sets BTC current energy value at US$81,284

Bitcoin has 6 months until ETF ‘liquidity crisis’

ETH

Dencun upgrade is here and sees a steep decline in Ethereum fees

Crypto Legal & Regulatory Landscape

Wright is officially not Satoshi says Judge

Ripple v. SEC Long Running suit about to end on March 22nd

Exchanges

Binance cuts ties with venture capital arm

Please keep in mind that this does not constitute financial advice.

Don't trust, verify and do your own research.